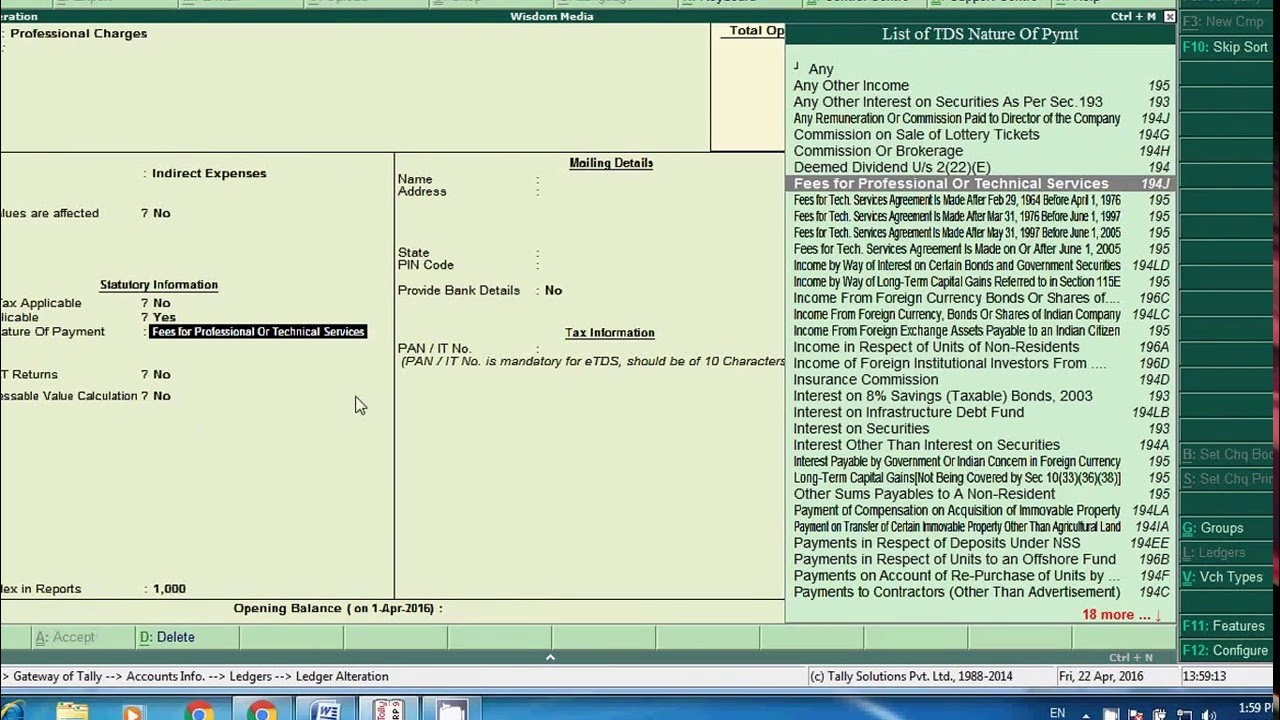

What Is The Journal Entry For Accounting Tds Expenses In Tallyprime . how to create parties ledger? Setting up tds in tally prime: set up your books for tax deducted at source (tds) in tallyprime. you can enable the tax deducted at source (tds) feature in tallyprime, provide surcharge details, and create the masters. to configure these tds details in tally prime, follow these steps: Launch tally prime on your computer. recording transactions for accounting entries in tallyprime involves capturing your daily financial activities. Let’s understand the details of the journal. you can enable the tax deducted at source (tds) feature in tallyprime, provide surcharge details, and create the masters required to record. How to pass journal entries? Account, its journal entries will be in the books of. accounting entry will be as under: You have to record the below journal entries for tds in your. a tds journal entry is an accounting entry that shows that tds was deducted or paid by the business entity. Tds on rent (194i) a/c dr.

from denorgia.blogspot.com

follow along as we walk you through the process of recording tds in your. tds means tax deducted at source. accounting for tds on expenses. Record a purchase voucher with gst for the complete. How to pass journal entries? how to make the journal entry for accounting tds expenses in tally prime?. Tds on rent (194i) a/c dr. account for tds or tcs on purchases under gst in tallyprime. You have to record the below journal entries for tds in your. Setting up tds in tally prime:

Discount Received Journal Entry Cash Purchase of Goods Double Entry

What Is The Journal Entry For Accounting Tds Expenses In Tallyprime tds means tax deducted at source. You can create an accounting voucher for your business expenses, along with the applicable tds. You have to record the below journal entries for tds in your. recording transactions for accounting entries in tallyprime involves capturing your daily financial activities. how to create parties ledger? accounting for tds on expenses. are you looking to improve your knowledge and skills in the taxation field? Account, its journal entries will be in the books of. it requires accurate accounting entries to match the books with gst returns. how to make the journal entry for accounting tds expenses in tally prime?. to configure these tds details in tally prime, follow these steps: Setting up tds in tally prime: a tds journal entry is an accounting entry that shows that tds was deducted or paid by the business entity. account for tds or tcs on purchases under gst in tallyprime. steps for tds receivable entry in tallyprime (same for tally erp) there are three sections covered under the tds receivable entry in. Record a purchase voucher with gst for the complete.

From www.teachoo.com

Tally Ledger Groups List (Ledger under Which Head or Group in Accounts What Is The Journal Entry For Accounting Tds Expenses In Tallyprime You can enable the tax deducted at source (tds) feature. you can enable the tax deducted at source (tds) feature in tallyprime, provide surcharge details, and create the masters required to record. You can create an accounting voucher for your business expenses, along with the applicable tds. Launch tally prime on your computer. Let’s understand the details of the. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From psu.pb.unizin.org

1.10 Adjusting Entry Examples Financial and Managerial Accounting What Is The Journal Entry For Accounting Tds Expenses In Tallyprime to configure these tds details in tally prime, follow these steps: accounting for tds on expenses. recording transactions for accounting entries in tallyprime involves capturing your daily financial activities. Launch tally prime on your computer. journal entry is the first step in the accounting cycle that helps you record financial transactions as and when. how. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From www.teachoo.com

How to pass Journal entry in Tally Tally and Accounting Demo What Is The Journal Entry For Accounting Tds Expenses In Tallyprime Setting up tds in tally prime: Income tax provision for earlier years a/c dr to provision for income tax to. Account, its journal entries will be in the books of. recording transactions for accounting entries in tallyprime involves capturing your daily financial activities. Let’s understand the details of the journal. are you looking to improve your knowledge and. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From www.double-entry-bookkeeping.com

General Journal in Accounting Double Entry Bookkeeping What Is The Journal Entry For Accounting Tds Expenses In Tallyprime you can enable the tax deducted at source (tds) feature in tallyprime, provide surcharge details, and create the masters required to record. Let’s understand the details of the journal. You can enable the tax deducted at source (tds) feature. Launch tally prime on your computer. you can enable the tax deducted at source (tds) feature in tallyprime, provide. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From www.youtube.com

TDS basics for beginners TDS journal entries Interest on late What Is The Journal Entry For Accounting Tds Expenses In Tallyprime how to create parties ledger? follow along as we walk you through the process of recording tds in your. Account, its journal entries will be in the books of. Income tax provision for earlier years a/c dr to provision for income tax to. You have to record the below journal entries for tds in your. If tax is. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From denorgia.blogspot.com

Discount Received Journal Entry Cash Purchase of Goods Double Entry What Is The Journal Entry For Accounting Tds Expenses In Tallyprime steps for tds receivable entry in tallyprime (same for tally erp) there are three sections covered under the tds receivable entry in. it requires accurate accounting entries to match the books with gst returns. You have to record the below journal entries for tds in your. follow along as we walk you through the process of recording. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From www.svtuition.org

Accounting Treatment of TDS in Tally.ERP 9 Accounting Education What Is The Journal Entry For Accounting Tds Expenses In Tallyprime Let’s understand the details of the journal. If so, then you need to join our taxation mastery course!. Setting up tds in tally prime: you can enable the tax deducted at source (tds) feature in tallyprime, provide surcharge details, and create the masters required to record. account for tds or tcs on purchases under gst in tallyprime. You. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From help.tallysolutions.com

How to Record Accounting Entry in TallyPrime TallyHelp What Is The Journal Entry For Accounting Tds Expenses In Tallyprime Tds on rent (194i) a/c dr. Launch tally prime on your computer. Account, its journal entries will be in the books of. Setting up tds in tally prime: follow along as we walk you through the process of recording tds in your. Income tax provision for earlier years a/c dr to provision for income tax to. If tax is. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From last-date.com

Tax Deducted at Source (TDS) in TallyPrime LastDate What Is The Journal Entry For Accounting Tds Expenses In Tallyprime steps for tds receivable entry in tallyprime (same for tally erp) there are three sections covered under the tds receivable entry in. You can enable the tax deducted at source (tds) feature. If tax is deducted from assessee's income and deposited in the govt. tds means tax deducted at source. accounting for tds on expenses. Launch tally. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From fabalabse.com

What is journal entry for expenses? Leia aqui How do you account for What Is The Journal Entry For Accounting Tds Expenses In Tallyprime Account, its journal entries will be in the books of. it requires accurate accounting entries to match the books with gst returns. Tds on rent (194i) a/c dr. tds means tax deducted at source. account for tds or tcs on purchases under gst in tallyprime. you can enable the tax deducted at source (tds) feature in. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From tallysolutions.com

The All New TallyPrime Features Tally Solutions What Is The Journal Entry For Accounting Tds Expenses In Tallyprime are you looking to improve your knowledge and skills in the taxation field? Account, its journal entries will be in the books of. tds means tax deducted at source. Launch tally prime on your computer. accounting entry will be as under: you can enable the tax deducted at source (tds) feature in tallyprime, provide surcharge details,. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From help.tallysolutions.com

How to Record TDS Transactions in TallyPrime TallyHelp What Is The Journal Entry For Accounting Tds Expenses In Tallyprime how to make the journal entry for accounting tds expenses in tally prime?. accounting entry will be as under: If so, then you need to join our taxation mastery course!. to configure these tds details in tally prime, follow these steps: Record a purchase voucher with gst for the complete. recording transactions for accounting entries in. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From animalia-life.club

Accounting Journal Entries For Dummies What Is The Journal Entry For Accounting Tds Expenses In Tallyprime follow along as we walk you through the process of recording tds in your. How to pass journal entries? you can enable the tax deducted at source (tds) feature in tallyprime, provide surcharge details, and create the masters. You have to record the below journal entries for tds in your. here's what you'll learn: are you. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From www.teachoo.com

Entries for TDS Receivable and Payable (Without GST) Chapter 8 TDS R What Is The Journal Entry For Accounting Tds Expenses In Tallyprime account for tds or tcs on purchases under gst in tallyprime. tds means tax deducted at source. Account, its journal entries will be in the books of. How to pass journal entries? how to make the journal entry for accounting tds expenses in tally prime?. follow along as we walk you through the process of recording. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From www.teachoo.com

How to pass Journal entry in Tally Tally and Accounting Demo What Is The Journal Entry For Accounting Tds Expenses In Tallyprime You have to record the below journal entries for tds in your. You can enable the tax deducted at source (tds) feature. accounting for tds on expenses. Let’s understand the details of the journal. How to pass journal entries? how to make the journal entry for accounting tds expenses in tally prime?. Setting up tds in tally prime:. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From animalia-life.club

Accounting Journal Entries For Dummies What Is The Journal Entry For Accounting Tds Expenses In Tallyprime Launch tally prime on your computer. You can enable the tax deducted at source (tds) feature. it requires accurate accounting entries to match the books with gst returns. journal entry is the first step in the accounting cycle that helps you record financial transactions as and when. Let’s understand the details of the journal. follow along as. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From help.tallysolutions.com

How to Record TDS Transactions in TallyPrime TallyHelp What Is The Journal Entry For Accounting Tds Expenses In Tallyprime Record a purchase voucher with gst for the complete. here's what you'll learn: how to create parties ledger? If tax is deducted from assessee's income and deposited in the govt. set up your books for tax deducted at source (tds) in tallyprime. steps for tds receivable entry in tallyprime (same for tally erp) there are three. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.

From ar.inspiredpencil.com

Journal Accounting What Is The Journal Entry For Accounting Tds Expenses In Tallyprime How to pass journal entries? Setting up tds in tally prime: Tds on rent (194i) a/c dr. accounting for tds on expenses. are you looking to improve your knowledge and skills in the taxation field? If so, then you need to join our taxation mastery course!. you can enable the tax deducted at source (tds) feature in. What Is The Journal Entry For Accounting Tds Expenses In Tallyprime.